Toyota’s forecast provides some light in a murky earnings season

An earnings season with no earnings forecasts is pretty dull, to say the least. So kudos to Akio Toyoda for his decision to provide earnings guidance - at a time when most Japanese industrials are neglecting to even hazard a guess at what the pandemic will do to their P&L. Toyota Motor expects a 22% fall in unit sales, 20% in revenue terms, and an 80% fall in OP for FY3/21 to Y500bn. That will probably prove conservative, as it often has before: coming out of the financial crisis, Toyota forecast a loss of Y850bn at the start of FY3/10, then went on to make a profit of Y148bn. Admittedly it was reeling from the shock of a Y460bn loss the previous year, on the back of a 22% revenue decline, so that forecast was given under some duress.

This new forecast may also be wrong. But what is interesting is Mr Toyoda’s assertion (in the Nikkei JP | EN) that the ability to remain profitable is the outcome of “strengthening the corporate structure,” which is Japanese-manager code for cutting costs. As it turns out, apart from the GFC and the recovery from it, Toyota’s gross margin and SG&A/sales have been highly consistent; it is spending the same SG&A to sales today as it did in 3/08, before the crisis hit, while gross margin is slightly lower (mainly due to currency):

blue: gross margin, red: SG&A/sales

Source: S&P CapitalIQ

Cost cuts in a crisis predict better performance beyond it

But wait a minute - look at that SG&A/sales line after FY3/09: having spiked to 12% with the fall in sales, Toyota had it down below 10% even before the top line and gross margin recovered - in fact it took some Y700bn out of SG&A by FY3/12. Perhaps what Mr Toyoda is really telling us is that the company will be even better at cutting overhead this time than it was post-Lehman?

If so, does that mean Toyota is a particular standout in its ability to cut costs in a crisis? Or will other companies be just as successful at doing so? If so, that might also be an indicator of likely operating performance coming out of the crisis. McKinsey reckons so - in a recent, excellent piece here. This is the killer quote:

“...resilient companies—those that most successfully weathered the 2008 downturn ... achieved three times the improvement in operating expenses as a percentage of revenue than their “nonresilient” peers, and did so substantially earlier, “saving their powder” and preserving capacity to invest in growth, while keeping SG&A in line with sales as revenue fell. Additionally, most companies classified as resilient stand apart from peers on multiple financial and operational metrics through both downturns and recovery…”

The article covers a number of stages of downturn and recovery, and provides a roadmap for CFOs to deploy SG&A in a sensible way both on the way down, and back up again as the business recovers. We believe this is particularly important for Japan - where managements are not known for nimbleness; fast reactions now might well enable a competitive advantage later.

the financial crisis SG&A “Crash diet”— and abenomics rebound

With that in mind, let’s investigate in relation to other listed companies: if a management has historically been adept at cutting SG&A, that might well mean we can count on the same in the coming couple of years. Time to run a screening. We looked at more liquid names in Japan to see who cut SG&A the most in FY3/12 vs FY3/08 - the “crash diet” phase - and while we are at it, we’ll check to see if any of them managed to keep the weight off, by maintaining or reducing SG&A/sales further. Our suspicion is 10 years of up-cycle plus labour and other cost inflation during the Abenomics era mean avoiding a rebound has been quite an achievement.

We’ll compare within broad industry groups, because of the difference in cost structures and also because like companies will generally have similar accounting treatments (i.e. comparable SG&A).

autos and parts - who was asleep at the wheel?

Source: S&P CapitalIQ, Vido Research

And the winner is… Mazda Motor. Carlos Ghosn might have been known as le cost-cutter at Nissan, but perhaps he was asleep at the wheel post Lehman? Nissan’s 33% SG&A cut pales in comparison with Mazda, which not only brought SG&A down by 56% from FY3/08 to FY3/12, but also reduced the ratio to sales further, even as the top line recovered after that. Toyota Industries wins the prize for the worst rebound since FY3/12; and the mothership Toyota Motor itself has been… nothing if not consistent.

Machinery - the McKinsey analysis plays out

Source: S&P CapitalIQ, Vido Research

Here, McKinsey’s analysis seems to play out: higher growth and higher margin names generally outdid their peers post GFC (Fanuc and SMC beating Yaskawa and CKD; Komatsu outdoing HCM). The story post FY3/12 is rather different, however, and Fanuc and Komatsu, along with Nabtesco and Kurita, look like having the most rebound fat to cut from here. Meanwhile the Heavy Industry names are looking a little heavy round the SG&A waistline, which may prove to be a burden in view of massive production cuts at their customer Boeing, and engine-making partner GE (WSJ here).

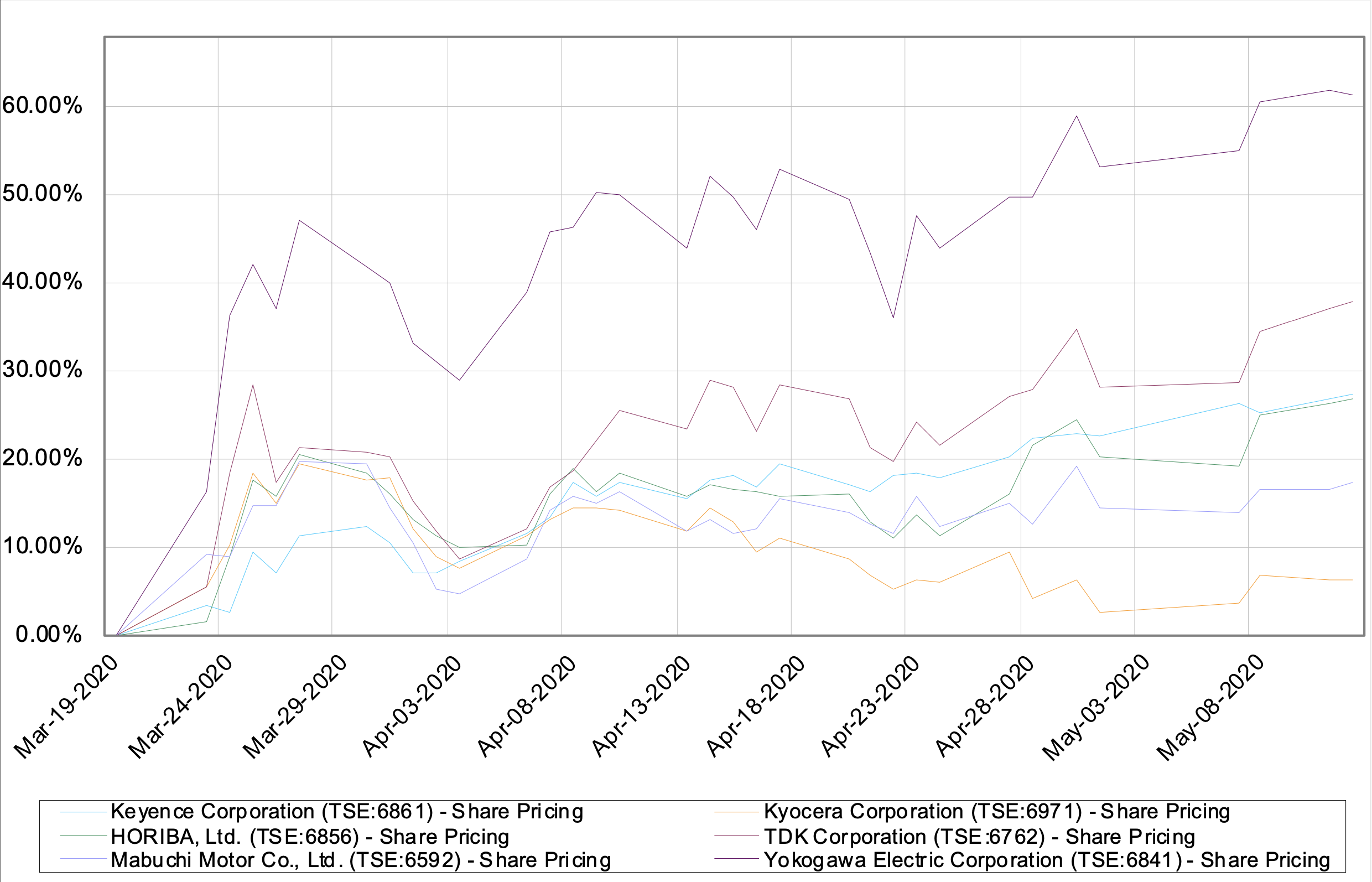

Elec components/elec machinery - habitual cost-controllers

Source: S&P CapitalIQ, Vido Research

A seriously hardcore bunch: six companies who cut SG&A/sales from 3/08 to 3/12, and then carried on to do more from 3/12 to 3/19, though the size of cut needed was not as great as for the autos. Arguably Keyence should be in the previous table (we relied on S&P CapitalIQ’s taxonomy), where it would have been a close second to SMC. Congratulations to the other five champions at cost control, among which Kyocera is a conspicuous laggard since the March 2020 lows…

Source: S&P CapitalIQ, Vido Research

Hopefully this analysis provides some clues as to which manufacturers will be best at managing the COVID-19 crisis, when it comes to cutting costs. Assessing them fully also requires an understanding of the end markets and, perhaps now more than ever, the quality of management. We are here to help - please get in touch.